FI Toolkit

How to Use

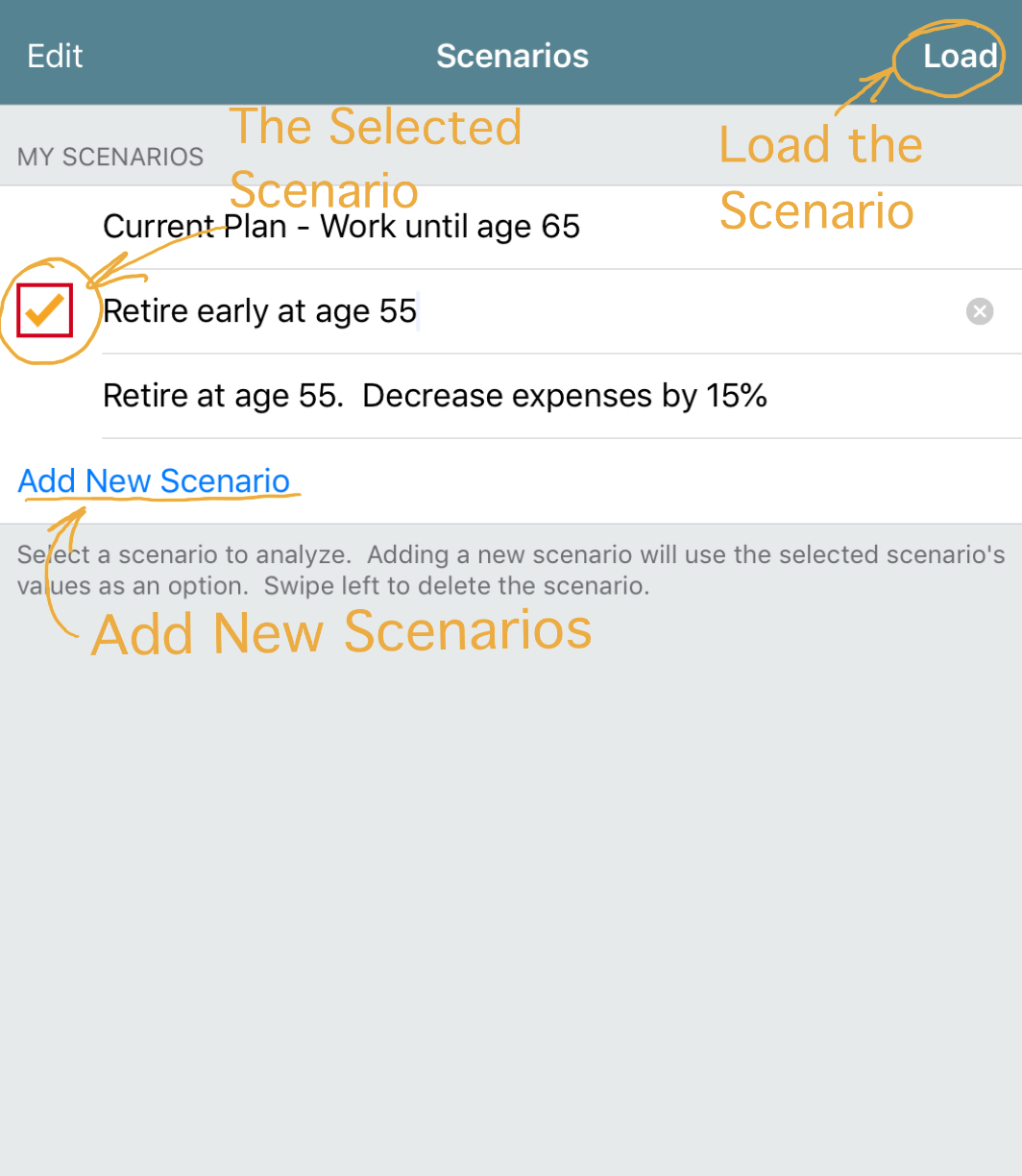

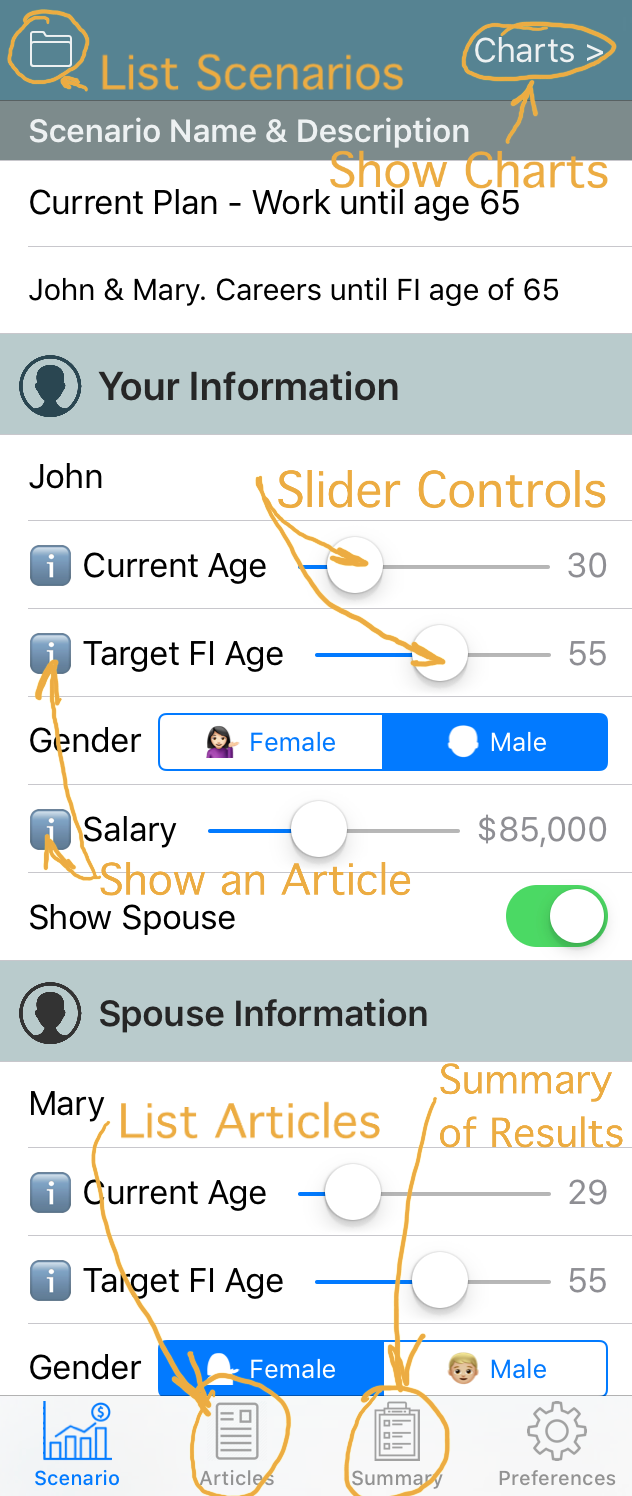

| FI Toolkit uses the concept of Scenarios to define sets of inputs for different financial plans you may want to create. A single scenario can usually describe your current financial situation and then, by changing input parameters, the scenario can be altered to see the impact of the changes on the final outcome. The recommended approach would be to use a single scenario for a time to fully understand the workings of the application before creating additional scenarios. Managing Scenarios Referring to the illustrated scenario screen from the next section, the folder button marked Load Scenario, will bring up a new screen for managing the creation and loading of new scenarios. You can create, edit and delete scenarios with the Scenarios management screen. When a new scenario is created, the option to duplicate an existing scenario will be presented. For example, you may want to duplicate a scenario that represents your current plan of working until age 65. You would then title the new scenario as Retire early at age 55. You would then load this scenario and adjust the input parameters to reflect the changes you would make to your plan and see the results in real time. Numerous scenarios can be created for the lifestyle paths you may consider. To return to the scenario input screen, select the desired scenario and press Load.  Scenario Input Screen The illustration below shows a set of inputs of an example scenario. The input screen is a scrollable list of inputs that control the function of the analysis that also creates the charts Account Balance and Spreadsheet. The Scenario Input Screen is the screen where most of the financial input information is entered to define the scenario.  Some of the controls shown include:

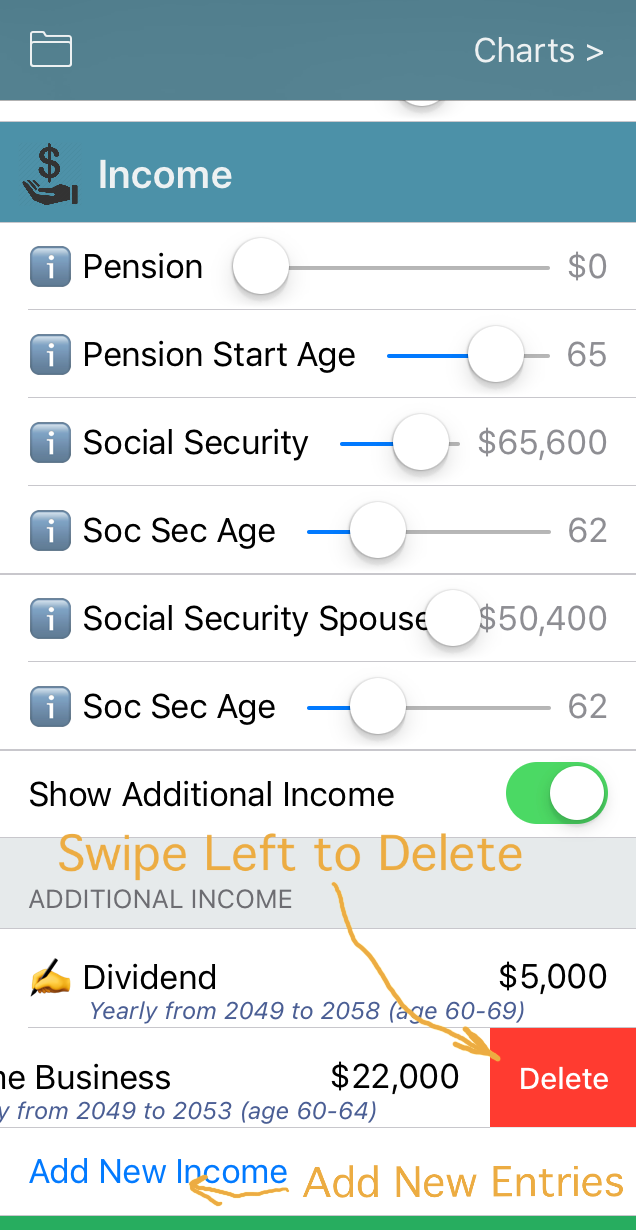

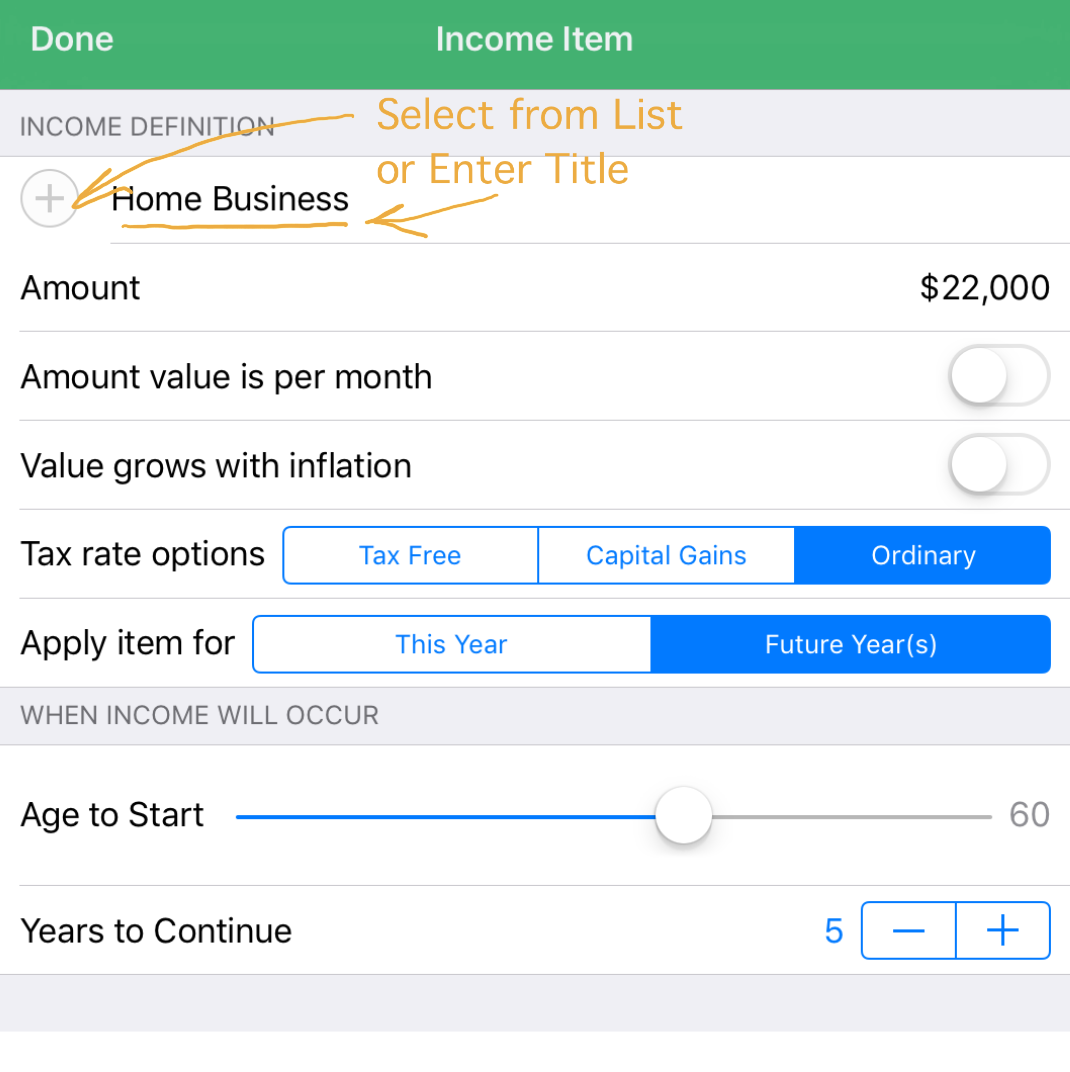

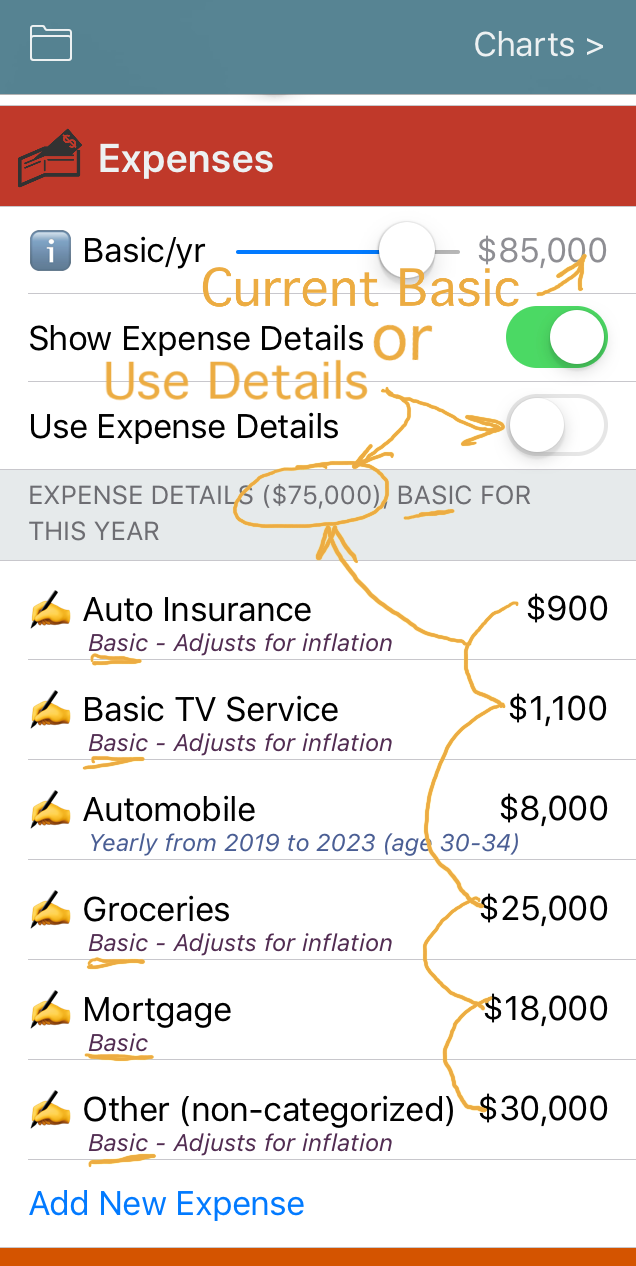

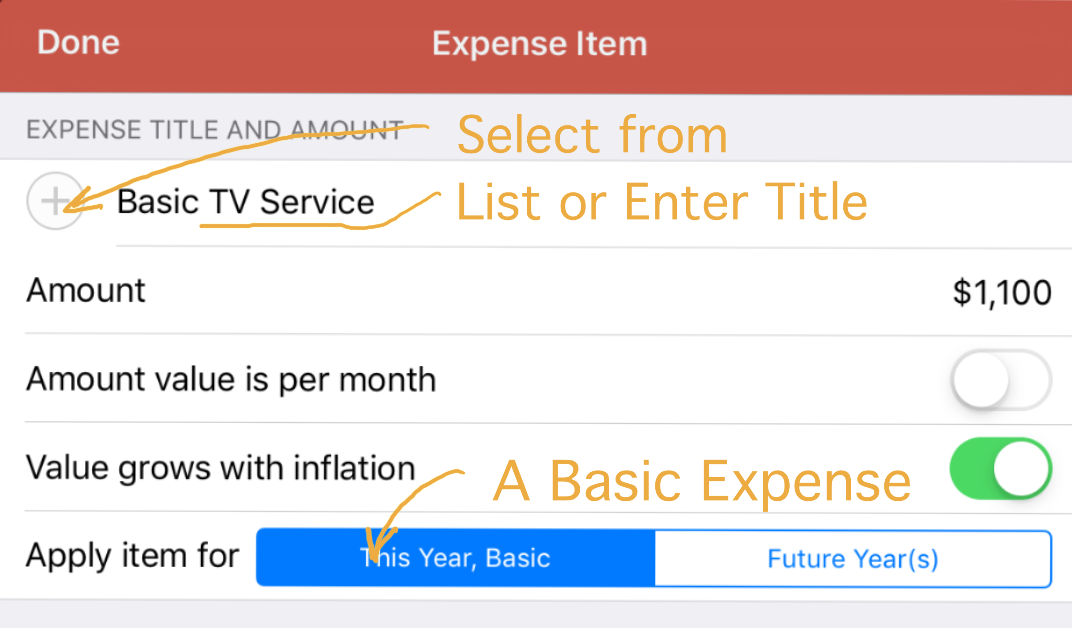

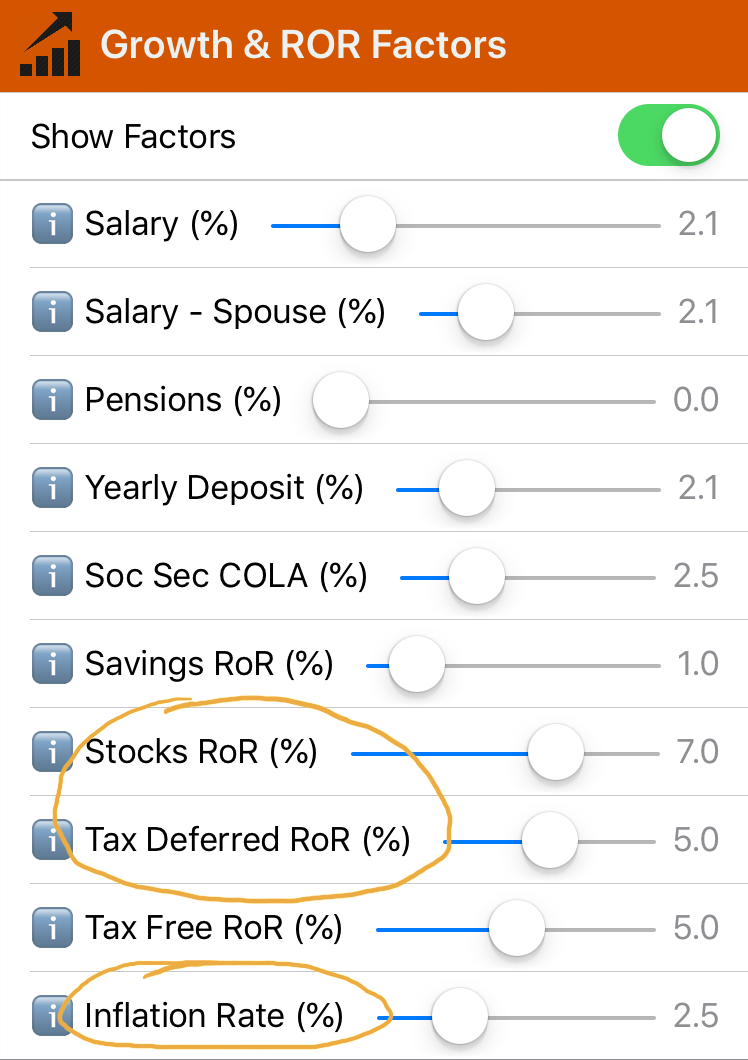

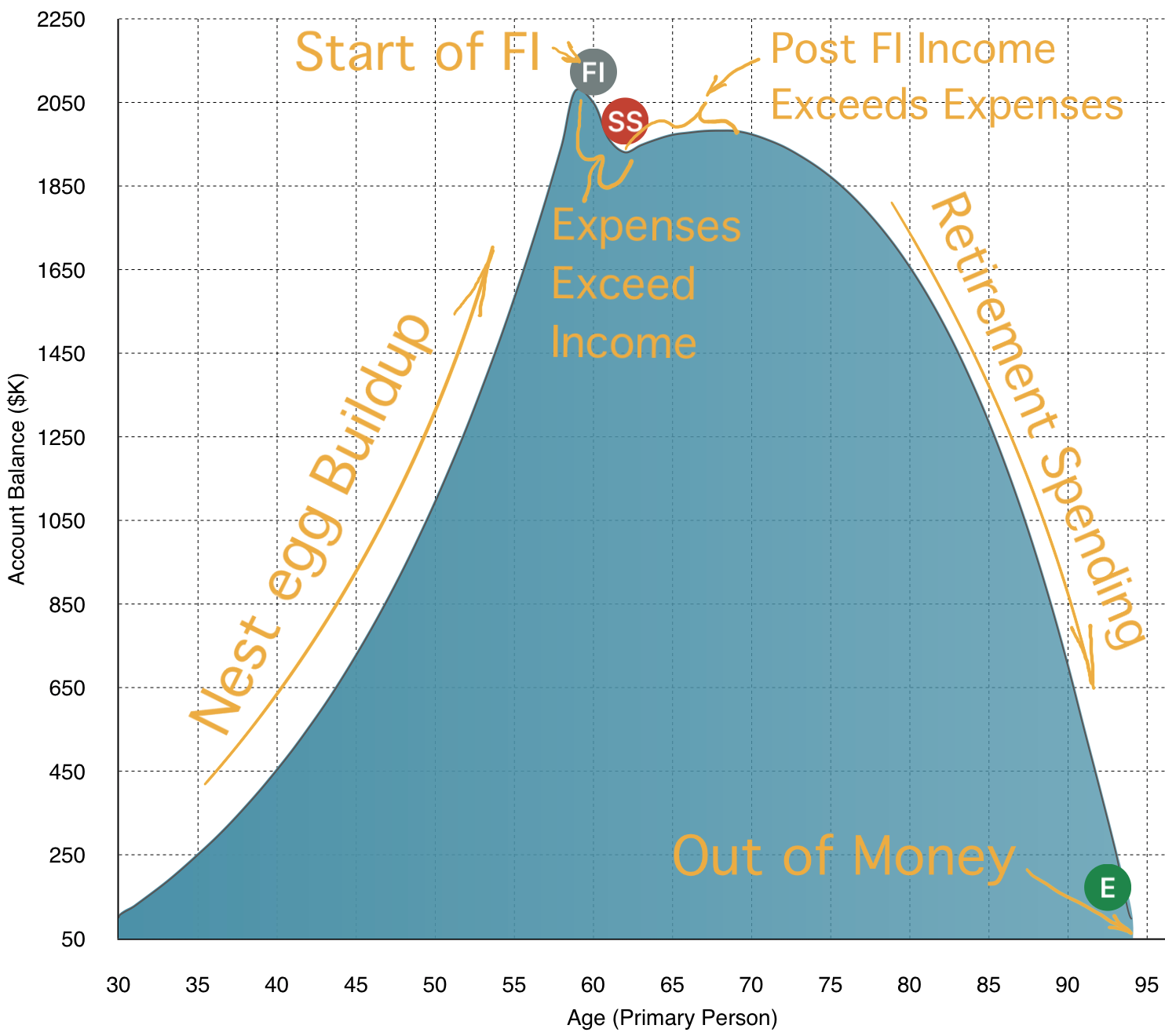

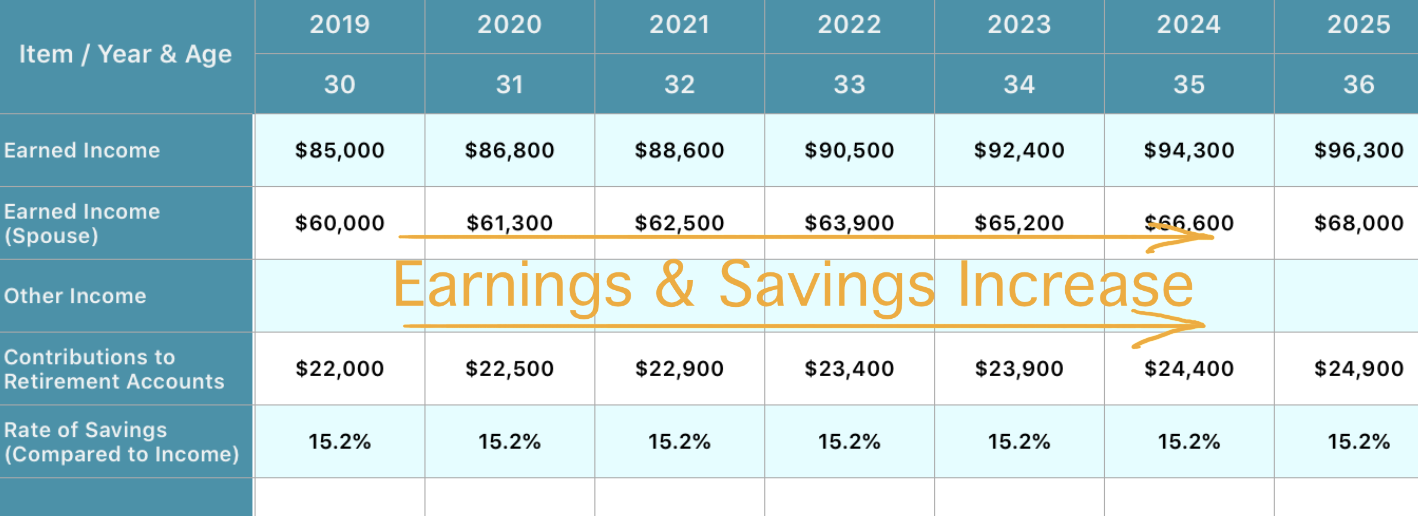

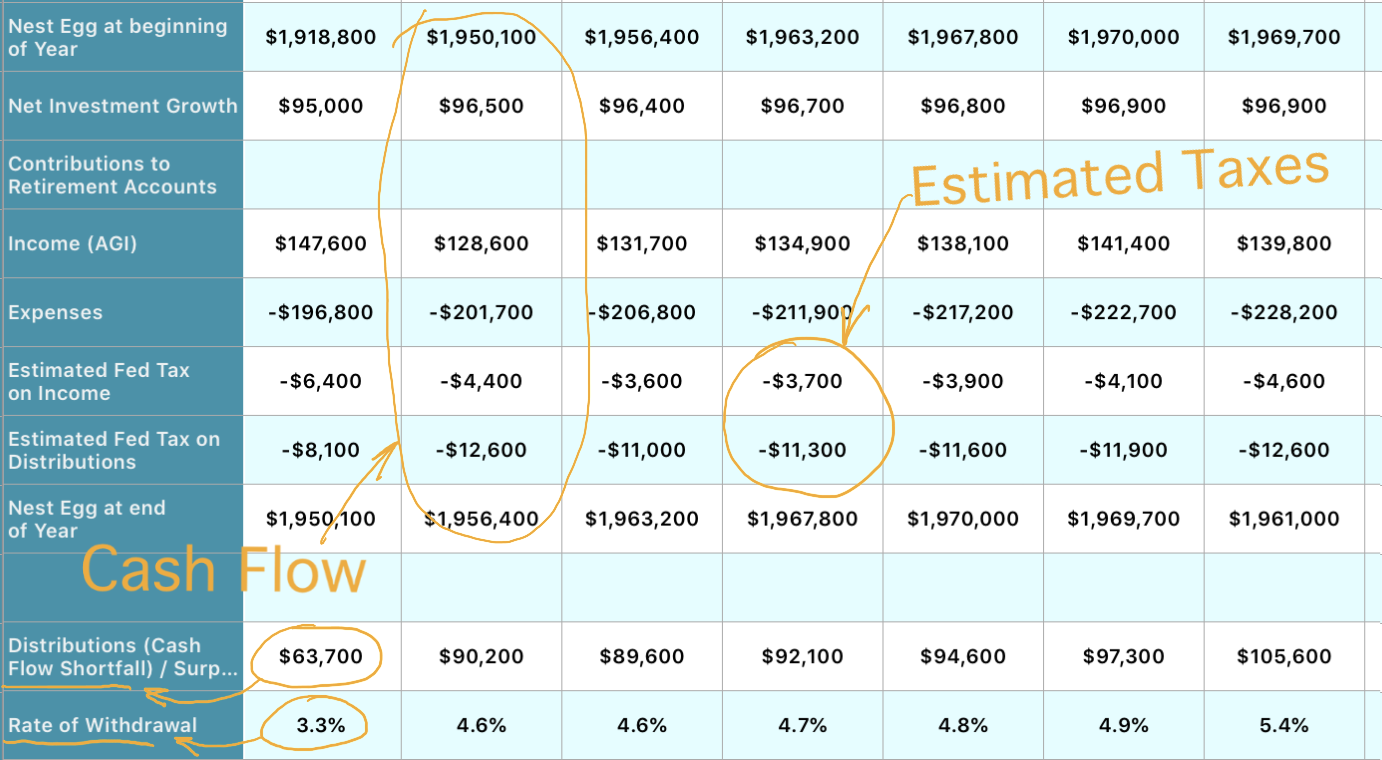

Adding Custom Income Items Scrolling down to the Income section of the Scenario Input screen, the following screenshot illustrates how to add and remove custom income entries. The income items can reflect anticipated post-FI income streams and are included in the total analysis and reflected in the details of the calculations.  When adding a new income item, another screen is presented in order to define the details of the income item (see the illustration below).  The income title may be selected from a predefined list, or entered directly. Adding Custom Expense Items Scrolling down to the Expenses section of the Scenario Input screen, the following screenshot illustrates how to add and remove custom expense entries. The expense items can reflect current and projected future expenses and are included in the total analysis and reflected in the details of the calculations.  Note that there is an option to override the Basic/yr expense slider value with the detailed expenses entered. The button Use Expense Details, when selected, will use the totaled values of the Basic expense details. This option allows an initial estimate of expenses to be entered, the value to be quickly changed using the slider for immediate results, then (as opportunity allows), the ability to create a more detailed expense profile for the current situation. When adding a new expense item, another screen is presented in order to define the details of the expense item (see the illustration below).  The expense title may be selected from a predefined list, or entered directly. To enter the expense as a basic yearly expense, select the This Year (Basic) option. Note that basic expenses and single or multi-year discretionary expenses may have inflation adjustments applied for future years if desired. Growth & ROR Factors Scrolling down to the Growth & ROR (rate-of-return) Factors section of the Scenario Input screen, the following screenshot illustrates the modifiable defaults for factors used in projecting future financial details. For example, the factors for account growth (i.e., Stocks RoR and Tax Deferred RoR) will be used to increase the account value yearly for the future calculations. Likewise, the Inflation Rate are used to increase the Basic Expenses yearly for the projected future expenses.  Account Balance Chart The Account Balance chart shows the projected account balance vs age. The calculations represent an analysis of the scenario inputs and calculated projections based on the application's methods, factors, and assumptions. The chart and the application is designed to graphically show the buildup of your financial nest-egg leading up to achieving FI, and then the post-FI drawdown of funds during the post-FI lifestyle years and in retirement. The illustration presented below highlights the key aspects of the chart and the meaning of the graphical results.  Spreadsheet Chart The Spreadsheet chart shows the detailed calculations for the elements that contribute to generating the Account Balance chart. These elements include savings deposits into the nest-egg accounts, growth of the nest-egg accounts due to rate-of-return factors, current and projected expenses, projected income for future years, and estimated taxes for income and account distributions. The following screenshots illustrate these elements and how to interpret them.  As shown above, the amount deposited into savings increases yearly based on the yearly deposit growth factor. Likewise, the expenses increase yearly based on the factor for inflation (see below). Similarly, the savings accounts increase because of yearly deposits to savings and the growth of the accounts due to ROR factors.  Scrolling to a different part of the spreadsheet, the screenshot below illustrates yearly columns with typical cash flow calculations. When total expenses (including estimated federal taxes) exceeds income, a cash shortfall exists that requires a Distribution from the nest-egg accounts. A Rate-of-Withdrawal (as a percentage of total funds) is calculated for reference.  |