FI Toolkit

Example

| Typical Scenario (John & Mary) John and Mary, age 30 and 29 years old, have been working their jobs for 8 years. They have saved approximately $75k from their combined salary of $135k per year. They just purchased a home and now expect to have yearly expenses of $85k/yr including their mortgage payment. They have become serious about achieving FI and have committed to saving $20k/yr (14.8% of their income) into their retirement plans. They expect to draw Social Security at an early age of 62. John & Mary's scenario is loaded

as the default example within FI Toolkit

when initially installed. Discover how John & Mary

might tweak their inputs (i.e., their FI plan) by following

along with this typical scenario example.

___________________________________

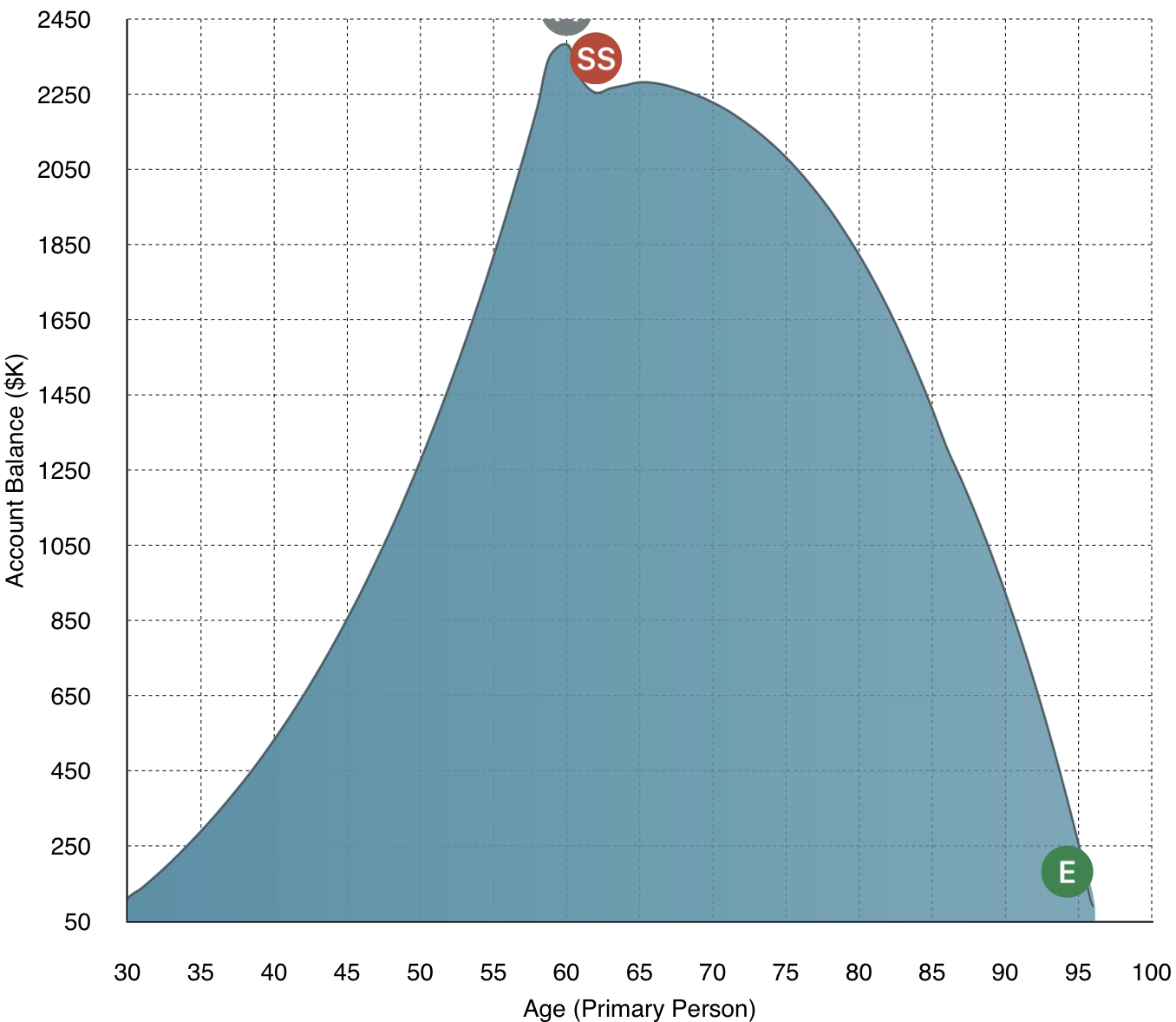

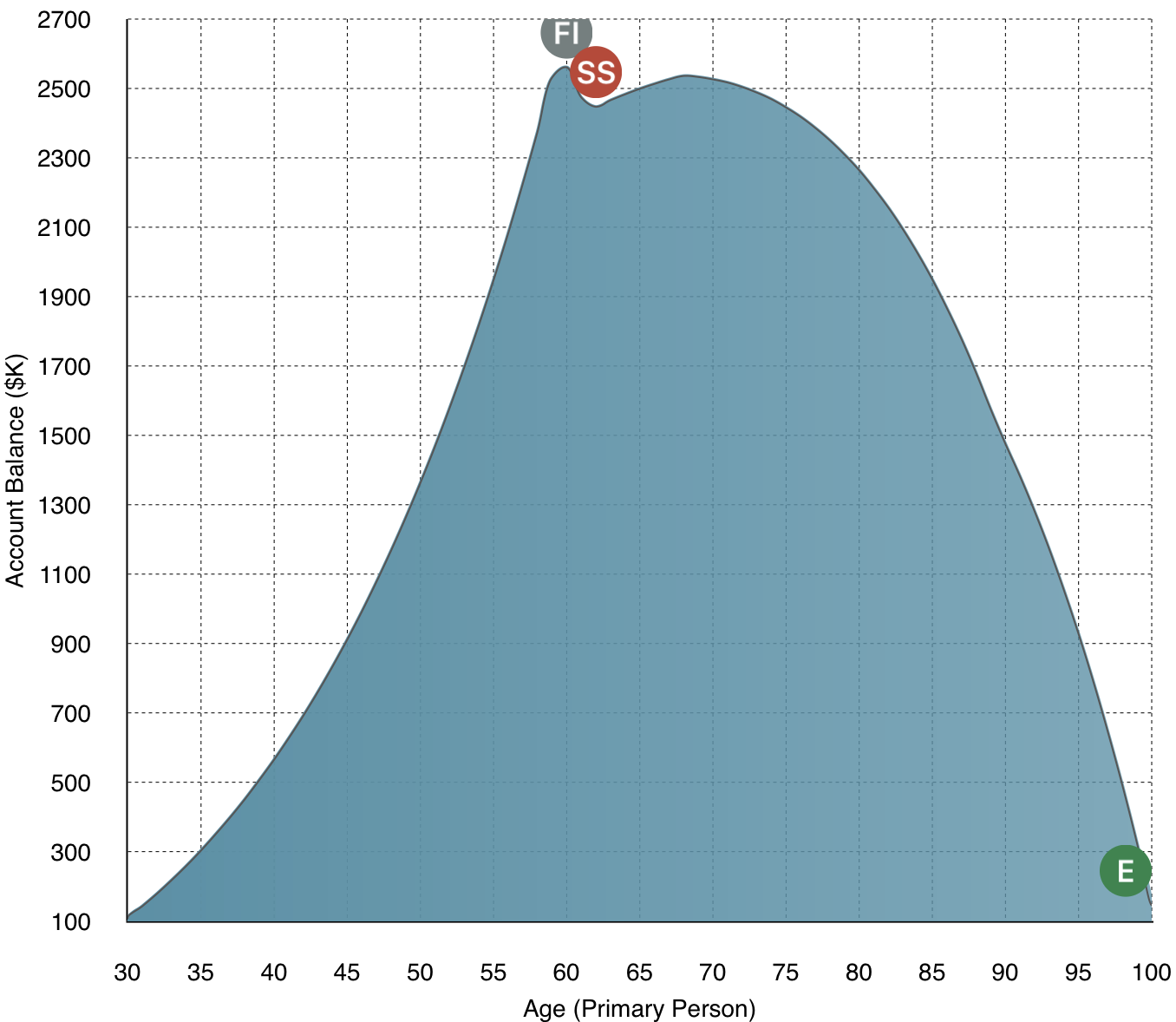

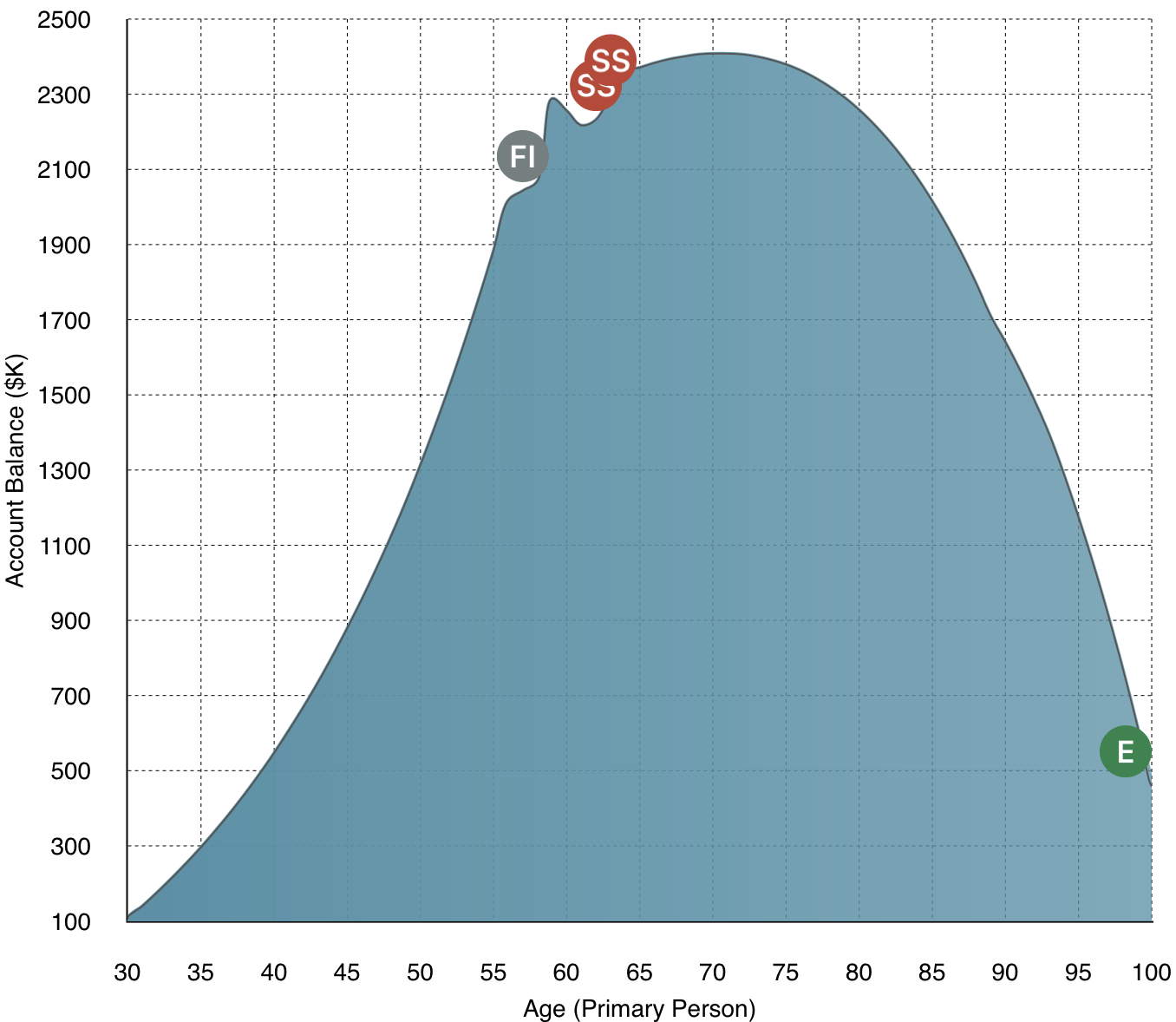

John & Mary After entering their basic information into FI Toolkit and setting John's FI age to 60, their plot of their finances show their money lasting to age 96.  Mary is not sure that running out of money at her age of 95 is wise and would like to see what changes would allow money to last longer than her life expectancy. Reducing expenses by $1k/year to

$84k/year, John & Mary's money appears to last beyond

Mary's life expectancy of 96. A similar result is

projected by earning an additional $3k/year of Salary.

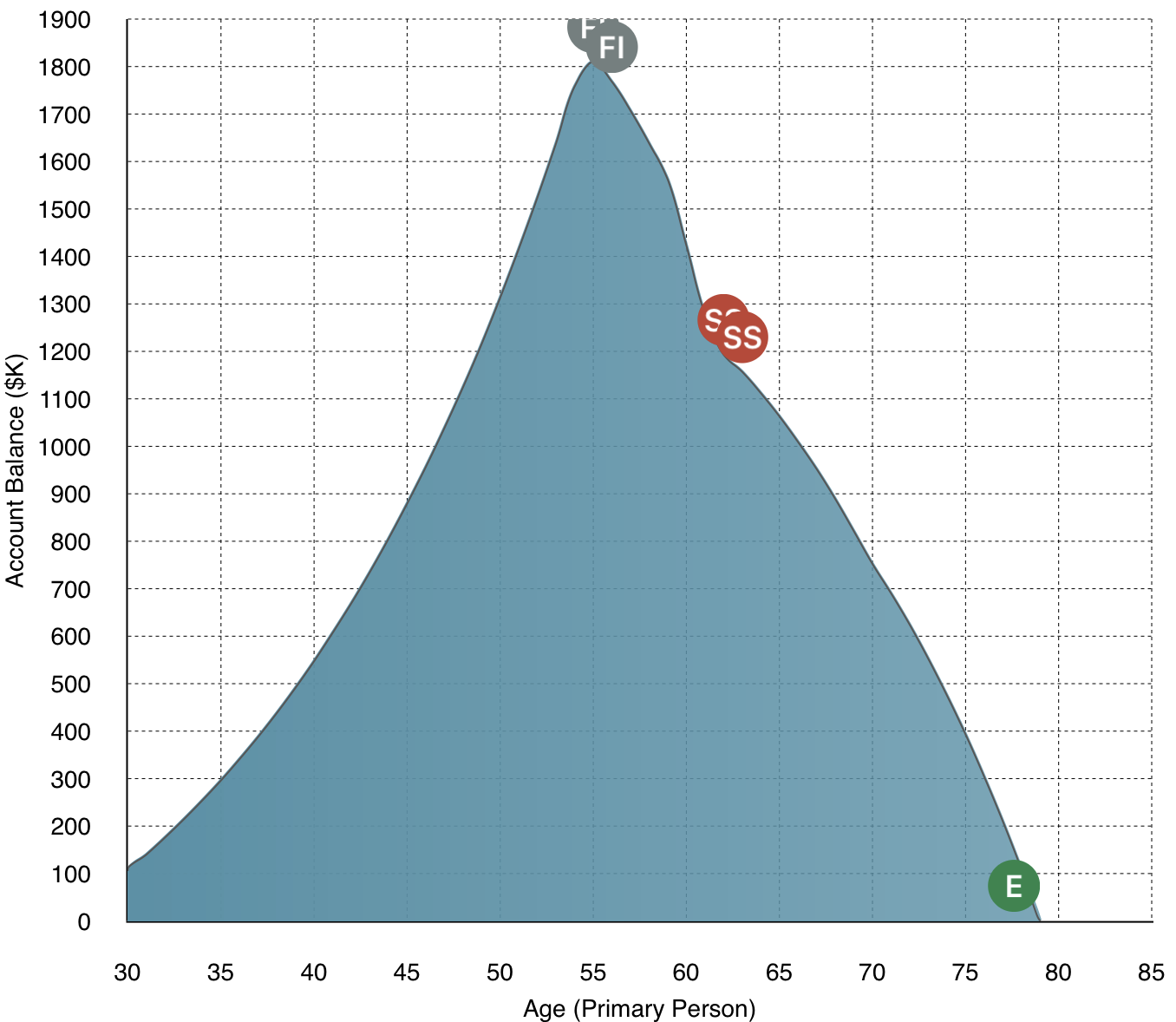

John, however, is not satisfied with FI at age 60. He wants to only work at his tech job until about 55 and then do some consulting while enjoying some hiking and travel with Mary. He looks at other creative changes to the FI Toolkit projection model.

With these changes, this is the result that John gets.  It appears that for three years starting at age 57, expenses will exceed income sources and start to dip into John's retirement funds. To avoid a 10% penalty, John needs to revise their plans. John falls short when setting their

target FI age to 55. The greatest challenge they face

is saving more by earning more while keeping their basic

expenses unchanged.

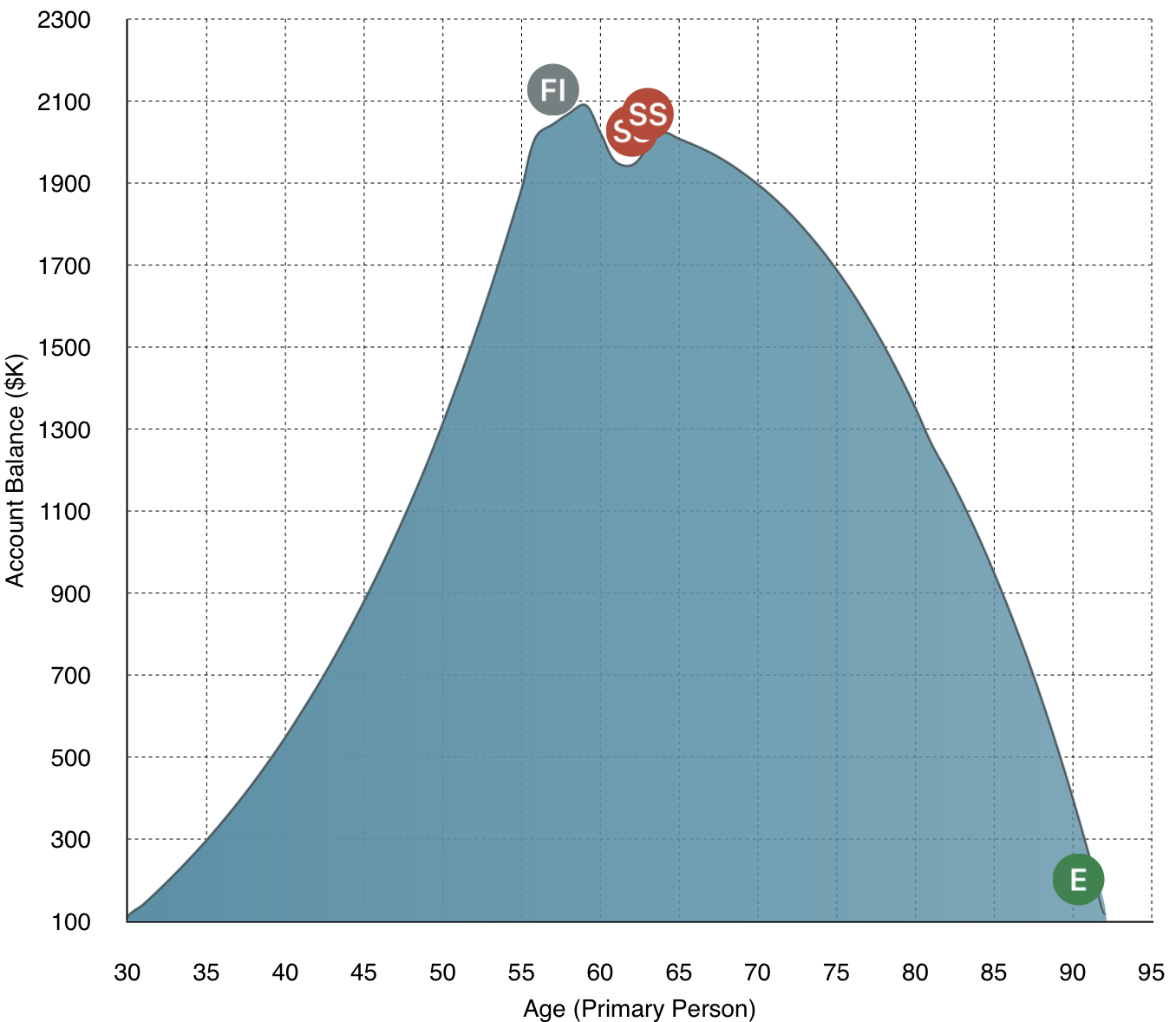

John decided to postpone FI until age 57. He then wonders if he can work 50% part time at his current job for 3 years post-FI. Mary could do the same. They would need to pursue this option nearer to that date. This would allow some travel time and time to setup his consulting gig.

With these changes, this plan seems is a little bit better.  While still way in the future, John and Mary thinks that downsizing their home and moving to another area would be a great way to tap their home equity and free up money for retirement expenses. Mary thinks that while they are working

part time and traveling, that they should look around for

their retirement home. They would find a location that

would be less expensive yet close to family and activities

they enjoy.

John figures that swapping their house for a downsized home or condo could yield $150k to $200k after their current house is paid off.

Their revised FI plan looks good.  John and Mary have what looks like a

workable plan. Like any long term plan with

uncertainties and projections, it may not go as

expected. John and Mary should revisit their plan and

compare it with reality on a regular yearly basis.

___________________________________

John & Mary's Conservative Approach John & Mary have a few conservative buffers within their plan. You should too. It is good to have some conservatism so that the plan has a reasonable probability of success. Let's look at a few of these. Salary Growth, and Retirement Contribution Growth The example John & Mary started with (i.e., the default settings) have growth factors set at 2.4% (nearly the same as inflation set at 2.5%). This means that their salary's only grow by 2.4% on a yearly basis. By contrast, the Social Security Administration projects salary growth to be ~ 4.2% (AWI is used to index an individual's earnings) on a yearly basis. The Social Security calculation would therefore produce a higher payout that John & Mary could have used if the scenario had used a 4.2% growth factor for salaries. The amount of Retirement Contributions deposited could have also grown at a higher rate than the default 2.4%. John and Mary did increase this to the maximum later which allowed make-up contributions to kick in at age 50. The default growth factors of 2.4% for

salary growth provide a conservative approach for projecting

future salary and related Social Security benefits

Account Rate-of-Return The example John & Mary started with (i.e., the default settings) have Rate-of-Return's of 4% set for account growth (Investment portfolio, Tax Deferred, and Tax Free accounts). Note that Investment portfolios often achieve average ROR's of 7% and is a reasonable expectation for future projections. Professional investment advisors (with

fiduciary responsibilities) can help ensure robust portfolio

growth

It may be quite possible that John & Mary can achieve higher returns through their employer managed retirement accounts. Or, through their personal brokerage account manager, they could receive higher stock portfolio returns.

___________________________________

John & Mary's Risks John and Mary have a few risks in their plan. Besides the unknowns that life may present and the uncertainty of projections, John & Mary should consider these risks. Early FI Age & Medical Insurance Coverage John and Mary wanted to start FI at an early age of 55. They had to compromise and postpone their FI age to 57 and then work half-time for the plan to work. Because Social Security benefits are based on the highest earnings for 35 years of work, their payments would be reduced considerably for their shortened and lower earning work periods. Also, since their benefits started at 62, there were years where expenses would come directly from savings. If a market downturn happens to occur during that time, their withdrawals would have an exaggerated negative impact. Early FI adds risk in regards to

medical insurance coverage and costs. Insurance costs

can be substantial in the gap years between the FI age and

the start of Medicare

John did not specifically address medical insurance costs as an added expense during the time between his FI age of 55 and the start of Medicare at the age of 65. Once he and Mary leave their employment, medical insurance is usually no longer covered. Unless the government improves universal medical coverage as a more guaranteed right for all people, individuals will need to purchase coverage. This represents a substantial risk because insurance costs are not trivial and should not be neglected in the plan. Non-Traditional Work Practices John and Mary proposed to work half time at their current jobs to make their plan work. Assumptions that may go against traditional work practices may not pan out in reality. John and Mary may have great employers now, but situations change. If your plan relies on non-traditional schemes that seem to make sense but in practice they may not, then have a backup plan.

___________________________________

In Conclusion A scenario is only as good as its inputs and assumptions. As a scenario or its variations are constructed, think about the realities that it must model. |